In determining how much output to supply, the firm's objective is to maximize profits subject to two constraints: the consumers' demand for the firm's product and the firm's costs of production. Consumer demand determines the price at which a perfectly competitive firm may sell its output. The costs of production are determined by the technology the firm uses. The firm's profits are the difference between its total revenues and total costs.

Total revenue and marginal revenue. A firm's total revenue is

the dollar amount that the firm earns from sales of its output. If a firm decides to supply the amount Q of output and the price in the perfectly competitive market is P, the firm's total revenue is A firm's marginal revenue is the dollar amount by which its total revenue changes in response to a 1-unit change in the firm's output. If a firm in a perfectly competitive market increases its output by 1 unit, it increases its total revenue by P × 1 = P. Hence, in a perfectly competitive market, the firm's marginal revenue is just equal to the market price, P.

Short‐run profit maximization. A firm maximizes its profits by choosing to supply the level of output where its marginal revenue equals its marginal cost. When marginal revenue exceeds marginal cost, the firm can earn greater profits by increasing its output. When marginal revenue is below marginal cost, the firm is losing money, and consequently, it must reduce its output. Profits are therefore maximized when the firm chooses the level of output where its marginal revenue equals its marginal cost.

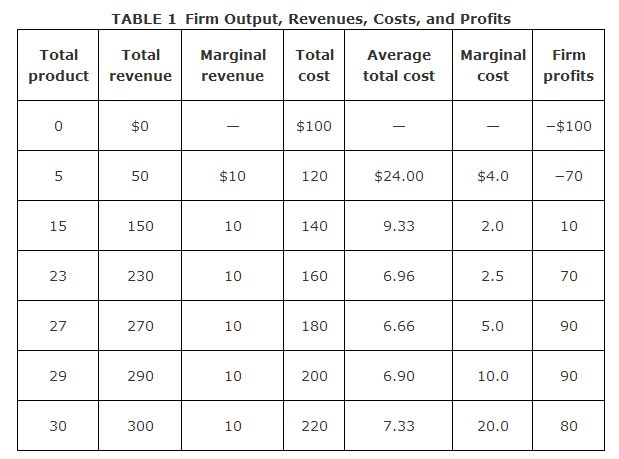

To illustrate the concept of profit maximization, consider again the example of the firm that produces a single good using only two inputs, labor and capital. In the short‐run, the amount of capital the firm uses is fixed at 1 unit. Assume that this firm is competing with many other firms in a perfectly competitive market. The price of the good sold in this market is $10 per unit. The firm's costs of production for different levels of output are the same as those considered in the numerical examples of the previous section, Theory of the Firm. These costs, along with the firm's total and marginal revenues and its profits for different levels of output, are reported in Table .

Because the price of the good is $10, the firm's total revenue is 10 × total product. The firm's marginal revenue is equal to the price of $10 per unit of total product. Notice that the marginal cost of the 29th unit produced is $10, while the marginal revenue from the 29th unit is also $10. Hence, the firm maximizes its profits by choosing to produce exactly 29 units of output. In choosing to produce 29 units of output, the firm earns $90 ($290 − 200) in profits.

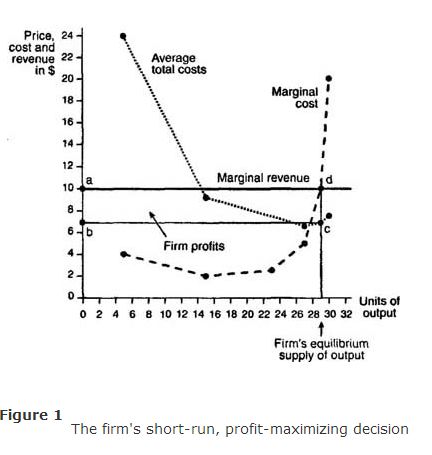

Graphical illustration of short‐run profit maximization. The marginal revenue, marginal cost, and average total cost figures reported in the numerical example of Table are shown in the graph in Figure .

The firm's equilibrium supply of 29 units of output is determined by the intersection of the marginal cost and marginal revenue curves (point d in Figure ). When the firm produces 29 units of output, its average total cost is found to be $6.90 (point c on the average total cost curve in Figure ). The firm's profits are therefore given by the area of the shaded rectangle labeled abed.

The area of this rectangle is easily calculated. The length of the rectangle is 29. The width is the difference between the market price (the firm's marginal revenue), $10, and the firm's average cost of producing 29 units, $6.90. This difference is ($10 × $6.90) = $3.10. Hence, the area of rectangle abed is 29 × $3.1 = $90, the same amount reported in Table . In general, the firm makes positive profits whenever its average total cost curve lies below its marginal revenue curve.

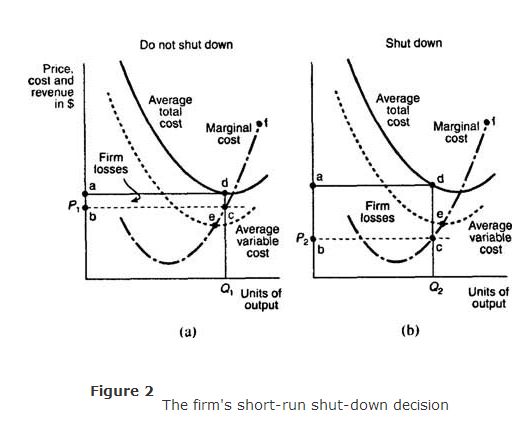

Short‐run losses and the shut‐down decision. When the firm's average total cost curve lies above its marginal revenue curve at the profit maximizing level of output, the firm is experiencing losses and will have to consider whether to shut down its operations. In making this determination, the firm will take into account its average variable costs rather than its average total costs. The difference between the firm's average total costs and its average variable costs is its average fixed costs. The firm must pay its fixed costs (for example, its purchases of factory space and equipment), regardless of whether it produces any output. Hence, the firm's fixed costs are considered sunk costs and will not have any bearing on whether the firm decides to shut down. Thus, the firm will focus on its average variable costs in determining whether to shut down.

If the firm's average variable costs are less than its marginal revenue at the profit maximizing level of output, the firm will not shut down in the short‐run. The firm is better off continuing its operations because it can cover its variable costs and use any remaining revenues to pay off some of its fixed costs. The fact that the firm can pay its variable costs is all that matters because in the short‐run, the firm's fixed costs are sunk; the firm must pay its fixed costs regardless of whether or not it decides to shut down. Of course, the firm will not continue to incur losses indefinitely. In the long‐run, a firm that is incurring losses will have to either shut down or reduce its fixed costs by changing its fixed factors of production in a manner that makes the firm's operations profitable.

The case where the firm is incurring short‐run losses but continues to operate is illustrated graphically in Figure (a). At the market price, P 1, the firm's profit maximizing quantity is Q 1. At this quantity, the firm's average total cost curve lies above its marginal revenue curve, which is the flat, dashed line denoting the price level, P 1. The firm's average variable cost curve, however, lies below its marginal revenue curve, implying that the firm is able to cover its variable costs. The firm's losses from producing quantity Q 1 at price P 1 are given by the area of the shaded rectangle, abcd. Despite these losses, the firm will decide not to shut down in the short‐run because it receives enough revenue to pay for its variable costs.

Figure (b) depicts a different scenario in which the firm's average total cost and average variable cost curves both lie above its marginal revenue curve, which is the dashed line at price P 2. The firm's losses are given by the area of the shaded rectangle, abed. In this situation, the firm will have to shut down in the short‐run because it is unable to cover even its variable costs. As a general rule, a firm will shut down production whenever its average variable costs exceed its marginal revenue at the profit maximizing level of output. If this is not the case, the firm may continue its operations in the short‐run, even though it may be experiencing losses.

Short‐run supply curve. The firm's short‐run supply curve is the portion of its marginal cost curve that lies above its average variable cost curve. As the market price rises, the firm will supply more of its product, in accordance with the law of supply. If, however, the market price, which is the firm's marginal revenue curve, falls below the firm's average variable cost, the firm will shut down and supply zero output.

The firm's short‐run supply curve is illustrated in Figures (a) and (b). Here, the firm's short‐run supply curve is the portion of the marginal cost curve labeled ef. The market short‐run supply curve, like the market demand curve, is simply the horizontal summation of all the individual firms' short‐run supply curves.