Capital, Loanable Funds, Interest Rate

The demand and supply for different types of capital take place in capital markets. In these capital markets, firms are typically demanders of capital, while households are typically suppliers of capital. Households supply capital goods indirectly, by choosing to save a portion of their incomes and lending these savings to banks. Banks, in turn, lend household savings to firms that use these funds to purchase capital goods.

Loanable funds. The term loanable funds is used to describe funds that are available for borrowing. Loanable funds consist of household savings and/or bank loans. Because investment in new capital goods is frequently made with loanable funds, the demand and supply of capital is often discussed in terms of the demand and supply of loanable funds.

Interest rate. The interest rate is the cost of demanding or borrowing loanable funds. Alternatively, the interest rate is the rate of return from supplying or lending loanable funds. The interest rate is typically measured as an annual percentage rate. For example, a firm that borrows $20,000 in funds for one year, at an annual interest rate of 5%, will have to repay the lender $21,000 at the end of the year; this amount includes the $20,000 borrowed plus $1,000 in interest ($20,000 × .05).

If the firm borrows $20,000 for two years at an annual interest rate of 5%, it will have to repay the lender $22,050 at the end of two years. After one year, the firm will owe the lender $21,000 as explained above; however, because the loan is for two years, the firm does not have to repay the lender until the end of the second year. During the second year, the firm is charged compound interest, which means it is charged interest on both the principal of $20,000 and the accumulated unpaid interest of $1,000. It is as though the firm receives a new loan at the beginning of the second year for $21,000. Thus, at the end of the second year, the firm repays the lender $21,000 + (21,000 × .05) = $22,050.

In general, the amount that has to be repaid on a loan of X dollars for t years at an annual interest rate of r is given by the formula

![]()

For example, if X = $20,000, r = .05, and t = 2, the amount repaid is found to be $20,000 × (1.05) 2 = $22,050.

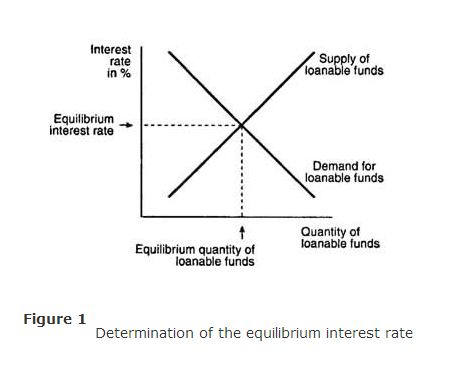

Determination of the equilibrium interest rate. The equilibrium interest rate is determined in the loanable funds market. All lenders and borrowers of loanable funds are participants in the loanable funds market. The total amount of funds supplied by lenders makes up the supply of loanable funds, while the total amount of funds demanded by borrowers makes up the demand for loanable funds. The loanable funds market is illustrated in Figure . The demand curve for loanable funds is downward sloping, indicating that at lower interest rates borrowers will demand more funds for investment. The supply curve for loanable funds is upward sloping, indicating that at higher interest rates lenders are willing to lend more funds to investors. The equilibrium interest rate is determined by the intersection of the demand and supply curves for loanable funds, as indicated in Figure .

Rate of return on capital and the demand for loanable funds. The demand for loanable funds takes account of the rate of return on capital. The rate of return on capital is the additional revenue that a firm can earn from its employment of new capital. This additional revenue is usually measured as a percentage rate per unit of time, which is why it is called the rate of return on capital. Firms will demand loanable funds as long as the rate of return on capital is greater than or equal to the interest rate paid on funds borrowed. If capital becomes more productive—that is, if the rate of return on capital increases—the demand curve for loanable funds depicted in Figure will shift out and to the right, causing the equilibrium interest rate to rise, ceteris paribus.

Thriftiness and the supply of loanable funds. The supply of loanable funds reflects the thriftiness of households and other lenders. If households become more thrifty—that is, if households decide to save more—the supply of loanable funds increases. The increase in the supply of loanable funds shifts the supply curve for loanable funds depicted in Figure down and to the right, causing the equilibrium interest rate to fall, ceteris paribus.