The income approach to measuring GDP is to add up all the income earned by households and firms in a single year. The rationale behind the income approach is that total expenditures on final goods and services are eventually received by households and firms in the form of wage, profit, rent, and interest income. Therefore, by adding together wage, profit, rent, and interest income, one should obtain the same value of GDP as is obtained using the expenditure approach.

There are two types of expenditures, however, that are included in the expenditure approach to GDP measurement but do not provide households or firms with any form of income: depreciation expenditures and indirect business taxes. Depreciation expenditures, made to replace existing but deteriorated investment goods, do increase the incomes of those providing the replacement goods, but they also decrease the profit incomes of those purchasing the replacement goods. The result is that aggregate income remains unchanged. Indirect business taxes consist of sales taxes and other excise taxes that firms collect but that are not regarded as a part of firms' incomes. Consequently, indirect business taxes are not included in the expenditure approach to determining GDP, rather it is included in the income approach.

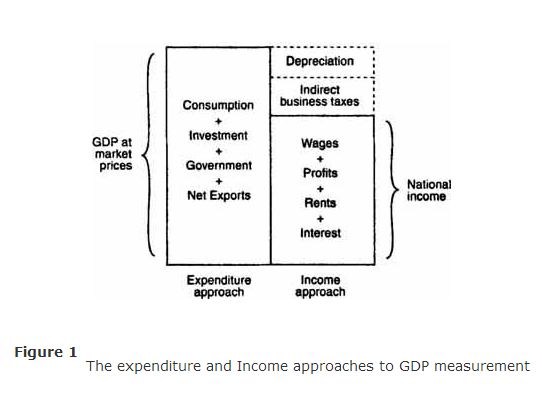

The difference between the expenditure and income approaches to GDP measurement is illustrated in Figure .

GDP is defined as the total market value of all expenditures made on consumption, investment, government, and net exports in one year. If one subtracts depreciation and indirect business taxes from these expenditures, one arrives at national income, which is the sum of all wage, profit, rent, and interest incomes earned in the same year.

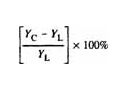

Growth rate of GDP. The value of GDP by itself is not very interesting. What is interesting is the annual growth rate, or year‐to‐year percentage change, in the value of GDP. To calculate the percentage change in a statistic, such as GDP, one needs to know the value of the statistic at two dates in time. Suppose that the value of GDP last year was Y L and the value of GDP in the current year is Y C. Then, the percentage change, or growth rate, of GDP is given by ![]()

This formula is valid for calculating the percentage change in any statistic, not just the percentage change in GDP.

A positive growth rate of GDP implies that the economy is expanding, while a negative growth rate of GDP implies that the economy is contracting. An expanding economy is said to be in a boom, while a contracting economy is said to be in a recession.