Aggregate Demand (AD) Curve

In macroeconomics, the focus is on the demand and supply of all goods and services produced by an economy. Accordingly, the demand for all individual goods and services is also combined and referred to as aggregate demand. The supply of all individual goods and services is also combined and referred to as aggregate supply. Like the demand and supply for individual goods and services, the aggregate demand and aggregate supply for an economy can be represented by a schedule, a curve, or by an algebraic equation

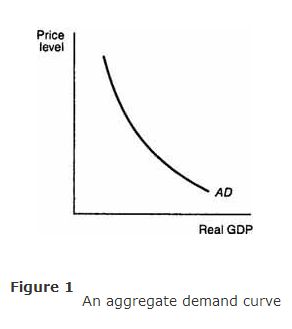

The aggregate demand curve represents the total quantity of all goods (and services) demanded by the economy at different price levels. An example of an aggregate demand curve is given in Figure .

The vertical axis represents the price level of all final goods and services. The aggregate price level is measured by either the GDP deflator or the CPI. The horizontal axis represents the real quantity of all goods and services purchased as measured by the level of real GDP. Notice that the aggregate demand curve, AD, like the demand curves for individual goods, is downward sloping, implying that there is an inverse relationship between the price level and the quantity demanded of real GDP.

The reasons for the downward‐sloping aggregate demand curve are different from the reasons given for the downward‐sloping demand curves for individual goods and services. The demand curve for an individual good is drawn under the assumption that the prices of other goods remain constant and the assumption that buyers' incomes remain constant. As the price of good X rises, the demand for good X falls because the relative price of other goods is lower and because buyers' real incomes will be reduced if they purchase good X at the higher price. The aggregate demand curve, however, is defined in terms of the price level. A change in the price level implies that many prices are changing, including the wages paid to workers. As wages change, so do incomes. Consequently, it is not possible to assume that prices and incomes remain constant in the construction of the aggregate demand curve. Hence, one cannot explain the downward slope of the aggregate demand curve using the same reasoning given for the downward‐sloping individual product demand curves.

Reasons for a downward‐sloping aggregate demand curve. Three reasons cause the aggregate demand curve to be downward sloping. The first is the wealth effect. The aggregate demand curve is drawn under the assumption that the government holds the supply of money constant. One can think of the supply of money as representing the economy's wealth at any moment in time. As the price level rises, the wealth of the economy, as measured by the supply of money, declines in value because the purchasing power of money falls. As buyers become poorer, they reduce their purchases of all goods and services. On the other hand, as the price level falls, the purchasing power of money rises. Buyers become wealthier and are able to purchase more goods and services than before. The wealth effect, therefore, provides one reason for the inverse relationship between the price level and real GDP that is reflected in the downward‐sloping demand curve.

A second reason is the interest rate effect. As the price level rises, households and firms require more money to handle their transactions. However, the supply of money is fixed. The increased demand for a fixed supply of money causes the price of money, the interest rate, to rise. As the interest rate rises, spending that is sensitive to rate of interest will decline. Hence, the interest rate effect provides another reason for the inverse relationship between the price level and the demand for real GDP.

The third and final reason is the net exports effect. As the domestic price level rises, foreign‐made goods become relatively cheaper so that the demand for imports increases. However, the rise in the domestic price level also means that domestic‐made goods are relatively more expensive to foreign buyers so that the demand for exports decreases. When exports decrease and imports increase, net exports (exports ‐ imports) decrease. Because net exports are a component of real GDP, the demand for real GDP declines as net exports decline.

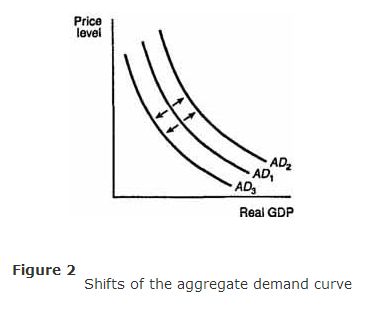

Changes in aggregate demand. Changes in aggregate demand are represented by shifts of the aggregate demand curve. An illustration of the two ways in which the aggregate demand curve can shift is provided in Figure .

A shift to the right of the aggregate demand curve. from AD 1 to AD 2, means that at the same price levels the quantity demanded of real GDP has increased. A shift to the left of the aggregate demand curve, from AD 1 to AD 3, means that at the same price levels the quantity demanded of real GDP has decreased.

Changes in aggregate demand are not caused by changes in the price level. Instead, they are caused by changes in the demand for any of the components of real GDP, changes in the demand for consumption goods and services, changes in investment spending, changes in the government's demand for goods and services, or changes in the demand for net exports.

Consider several examples. Suppose consumers were to decrease their spending on all goods and services, perhaps as a result of a recession. Then, the aggregate demand curve would shift to the left. Suppose interest rates were to fall so that investors increased their investment spending; the aggregate demand curve would shift to the right. If government were to cut spending to reduce a budget deficit, the aggregate demand curve would shift to the left. If the incomes of foreigners were to rise, enabling them to demand more domestic‐made goods, net exports would increase, and aggregate demand would shift to the right. These are just a few of the many possible ways the aggregate demand curve may shift. None of these explanations, however, has anything to do with changes in the price level.